Your voice is needed TODAY to stop vouchers and cuts to Medicaid, Medicare, and SNAP

While we were sleeping, congress was working the bill that will take healthcare from millions while providing trillions in tax cuts for the top 1%.

TIME IS OF THE ESSENCE with this one, so feel free to skip straight to the TAKE ACTION section.

Legislating in the Dark

A few hours ago the House Rules Committee wrapped up a meeting that began at 1:00 am. Overnight legislating is rarely a good thing.

This committee hearing was the final step before sending the so-called “big, beautiful bill” to the floor of the House for a vote. The Rules Committee (led by the GOP majority) is responsible for setting the rules of debate for the bill and they can make amendments.

I don’t know the full scope of any changes, but we do know the following (among many other things) are included in the bill:

$715 billion in cuts to Medicaid and $300 bill from the SNAP food assistance program

voucher program that will divert $20 billion in our tax dollars over the next four years to private schools

$500 billion in Medicare cuts due to the Pay-As-You-Go trigger that will go into effect with the expected deficit increase, per the Congressional Budget Office

The final vote in the House could happen TODAY! Trump is said to be meeting at 3 pm today with GOP members of the House pressuring legislators to pass the reconciliation bill. House Speaker, Mike Johnson, is rushing the bill to try to pass it before the Memorial Day weekend.

ALL HANDS ON DECK…We must use our voices NOW!

Even if you’ve already made a phone call — call again!

Encourage someone else to use their voice too — now is the time! Think of someone in Kansas and someone in another state. I have friends and family in Iowa that I will be contacting.

Keep calling through the end of the week until the vote has been taken. Every day we can delay a vote is another day for legislators and the public to fully understand the harmful impacts included in the bill so we can potentially stop it.

Hurting the vulnerable to benefit the wealthy

The main thing to understand is that this massive 1,116-page budget reconciliation bill is cutting healthcare (Medicaid & now Medicare) and food assistance programs (SNAP) for vulnerable populations to pay for tax cuts that primarily benefit high income households and profitable corporations.

It also provides a lucrative tax shelter for wealthy individuals to fund a private school voucher program that undermines our public education system relied upon by 90% of kids in the United States.

There’s so much more in this bill, but it’s impossible to focus on it all.

STOP VOUCHERS & CUTS TO MEDICAID, SNAP, AND MEDICARE

We need congressional office phones to be ringing off the hook.

Finding your US House Representative

Use ksleglookup.org/search to find your US House Representative and their D.C. and local office (by clicking on “More”) phone numbers. If the D.C. number is busy leave a message and try to reach someone in a local office.

That link can be used by anyone in the country to find their federal level representative.

Or use the Hands Off Medicaid Hotline (866-426-2631)

This number provides you with some information about the Medicaid cuts and some messaging you can use. By entering your zip code, you will be transferred to your legislator’s office.

If you use this number, please remember to also mention your opposition to the cuts to food assistance programs and Medicare, and your opposition to the federal voucher program.

Calling is easy, I promise

A staffer will answer. Start your call by providing your name, city, and zip code. Then just let them know why you are calling — asking the representative to vote no on the reconciliation bill. Tell them you are specifically opposed to the:

cuts to Medicaid

cuts to the SNAP food assistance program

federal school voucher program

cuts to Medicare due to the Pay-As-You-Go trigger

It can really be that simple. Or add some of the points in the sample message below or in the bullet points to follow. But, feel free to keep your call short. Volume of calls is important right now.

If you have a story to share…PLEASE DO! Examples:

You or someone you know relies on (or has needed at some point) Medicaid, Medicare, or SNAP

You live in a rural area where a hospital or healthcare provider has gone out of business

Your child would not be accepted by a private school due to special needs, etc.

You live in a rural area without private school options

If you get voicemail, go ahead and leave your message.

Staffers tally the opposition (or support) for the various issues in phone calls and voicemails and provide the summaries to the legislator.

Sample Message with additional wording (your call doesn’t have to include all of this)

Hello. My name is __________ and I’m calling from [city], zip code ________. I urge the representative to vote no on the reconciliation bill that provides tax cuts that primarily benefit the top 1% at the expense of the most vulnerable Americans.

I’m specifically opposed to the cuts to Medicaid, Medicare, and SNAP food assistance programs. And I’m also opposed to the federal school voucher program included in the bill.

Kansas children, the elderly, and individuals with disabilities will be bogged down with red tape and stand to lose their health insurance. Families could lose the Home & Community Based Services they rely upon to keep their children with complex medical needs at home. This will also lead to higher health care costs for all of us and could result in physicians, other healthcare providers, and rural hospitals going out of business.

Cutting SNAP benefits will hurt Kansas communities and local economies, but especially those in rural areas. 187,000 Kansans receive SNAP benefits (including families trying to feed their children) to supplement their grocery budgets.

The Education Scholarship voucher program that has been tucked into the reconciliation bill is simply another tax shelter for the wealthy. Public dollars belong with public schools. While cuts are being made to our public schools, we should not be using our tax dollars to fund private schools.

The Congressional Budget Office reported this week that the deficit created by the reconciliation bill will lead to $500 billion in cuts to Medicare due to the Pay-As-You-Go trigger.

Thank you.

More information on Medicaid & SNAP Cuts

Much of the information below was taken from a recent Kansas Action for Children email alert.

Medicaid cuts threaten Home & Community Based Services that help kids and others with medically complex needs remain at home with their families.

Medicaid cuts at the federal level hurt everyone. The state may be forced to lower Medicaid reimbursement rates which could put healthcare providers (from physicians to speech therapists) out of business and result in the closure of more rural hospitals.

In Kansas, around 440,000 are enrolled in Medicaid (KanCare in Kansas) and about 187,000 receive SNAP to supplement their grocery budgets. If Congress moves forward with these massive cuts, thousands will go uninsured and won't have enough food to eat.

Reducing the amount of federal funding Kansas receives for its Medicaid and SNAP programs will bust the state’s budget and make it harder to adequately fund K-12 education, infrastructure projects, and other services Kansans rely on.

Cutting SNAP benefits and Medicaid funding will hit rural communities hard by taking dollars out of local economies.

More information on the Voucher Program

Some of the information below was taken from an Institute of Taxation and Economic Policy article and the joint statement from the SMSD, Blue Valley, and Olathe superintendents who oppose the federal voucher program.

The federal voucher program will divert $20 billion in federal tax dollars over the next four years to private schools.

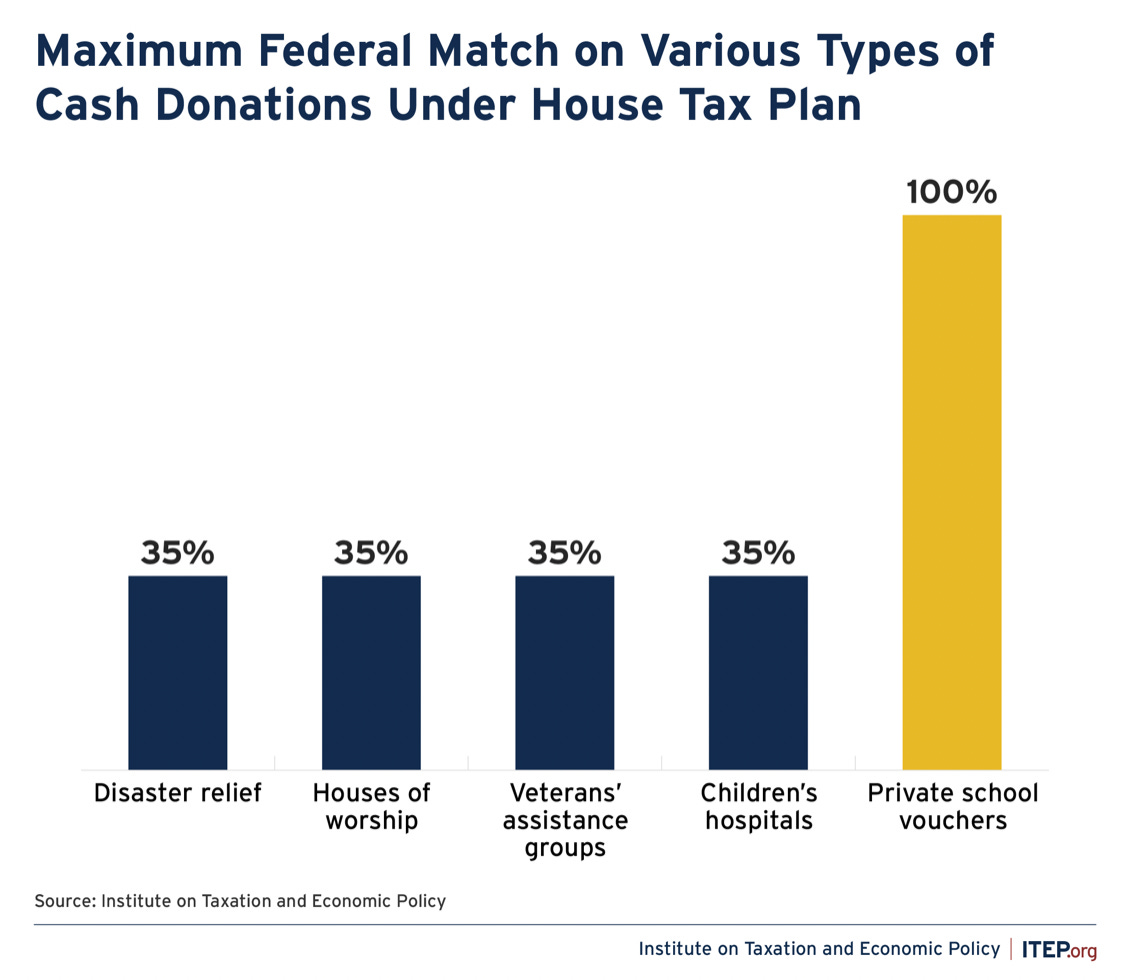

Donors to the voucher program receive more financial incentives than donors to all other charities.

Donors to organizations like Children’s hospitals or veterans’ assistance groups would receive no more than 35 cents in tax savings for each dollar donated, while donors to private K-12 school voucher groups would receive a full reimbursement of their donations.

The bill would also allow private school voucher donors to avoid capital gains tax on their gifts of corporate stock. The effect would be a profitable tax shelter for wealthy people who agree to help funnel public funds into private schools.

Vouchers predominately benefit families already attending private schools, many who can easily afford tuition. Under the federal voucher program, eligible families would receive $5,000 per child to pay for private school tuition.

A family with three kids already attending a private school and with a household income of $242,000 (or more, depending on where they live) would would receive $15,000 in tuition reimbursement.1

Private schools are not held to the same standards of access or accountability. They:

can deny admission to students with disabilities, behavioral needs or limited English proficiency

are not required to provide special education services or mental health supports

may exclude students based on family background, religion or identity

can dismiss students who struggle academically or behaviorally

Public schools cannot—and would not—turn students away. Public schools educate every child who walks through the doors.

The federal voucher program would reduce funding for public schools that are already challenged to address rising costs in areas such as special education, staffing, health care, technology and infrastructure.

We can stop this bill by using our voices!

Call today

Call tomorrow

Keep calling until a vote has been taken

Encourage others to call! Especially those in other parts of Kansas and in other states.

Calculated using the median household income of all Americans per the 2023 US Census. The bill allows those making 300% of the median household income for their area to receive a voucher of $5000 per child.